- Weekly Good News Report

- Posts

- 3 Financial Steps to Take During a Government Shutdown

3 Financial Steps to Take During a Government Shutdown

What’s Inside: Check my CTV News Segment, big Social Security Changes for 2026, US Gataways and more!

Latest Good News: I Was Featured on CTV News!

Upcoming Event: You’re Invited: Learn How to Maximize Your Social Security Benefits Workshop

Education: 3 Financial Steps to Take During a Government Shutdown (video)

Industry News: Big Social Security Change: Higher Tax Limits Ahead for 2026

Lifestyle Tips: Seven US Getaways That Feel Like an International Vacation

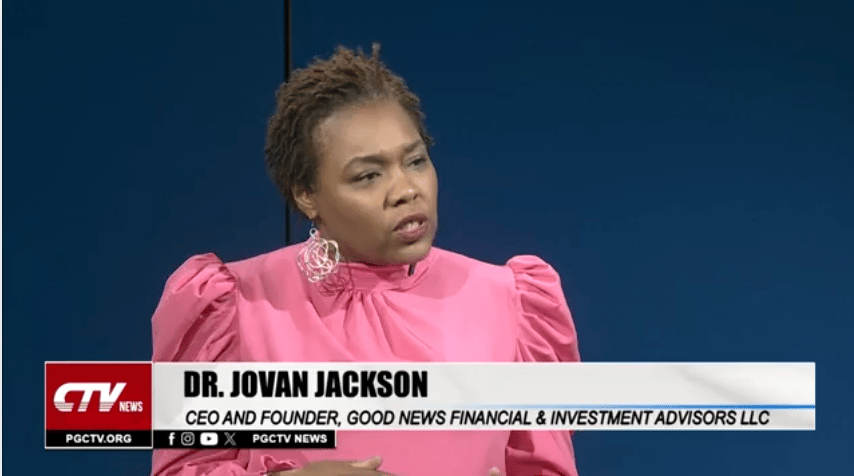

I Was Featured on CTV News!

Watch My Segment on the Government Shutdown

Happy Winsday!

I pray you're doing well.

What time is it?👂🏽

GOOD NEWS TIME!!!🎉🎉

I wanted to share something exciting!!! 🙌🏾✨

I was recently featured on CTV News to talk about how to navigate the financial stress of the government shutdown. 🙌🏾

If you’re a federal employee or know someone who is, this segment was made with you in mind. I shared practical advice on:

✔️ What to do first when a shutdown hits

✔️ Whether or not to take out loans

✔️ How to prioritize bills and stretch your budget

✔️ A few words of encouragement (because I know it’s not easy)

I’m grateful for the opportunity to share what I know and hopefully ease some of the stress this season is bringing to so many families.

Thanks for always cheering me on, and if you find the info helpful, feel free to share it with someone who needs it right now.

You can catch my segment starting at minute 21:52 right here:

You’re Invited:

Hey Friend,

I’m so excited to share that I’ll be hosting an in-person educational workshop designed to help you make smarter, more confident decisions about your Social Security benefits and you’re invited!

Date & Time: Saturday, November 1st at 10:00 AM

Location: Baltimore County Public Library

1100 Frederick Road, Catonsville, MD 21228

Cost: FREE

For many Americans, Social Security is the single largest asset they have in retirement, yet over 90% of recipients fail to maximize their benefits.

In this workshop, I’ll walk you through the key strategies to:

✔️ Coordinate spousal and survivor benefits effectively

✔️ Minimize taxes on your retirement income

✔️ Choose the right time to claim your benefits

✔️ Avoid common mistakes that can cost you over $100,000 in lifetime benefits

Whether you’re single, married, divorced, or widowed, there are ways to maximize what you receive and it all starts with the right plan.

🎟️ Seats are limited, so be sure to register today and secure your spot!

👉 Click here to register now

And if you know someone nearing retirement or already collecting benefits, please share this with them, it could make a life changing difference.

I can’t wait to see you there and help you make the most of what you’ve worked so hard for!

📖Money Motives Education

***This Week***

In this installment, we'll explore

“3 Financial Steps to Take During a Government Shutdown”

In a world filled with negative headlines about economic struggles and market volatility, we focus on the positive aspects shaping our financial landscape.

"Money Motives" aims to change the narrative with fresh perspectives on money and investments.

Tune in every Wednesday for a new installment of Good News from the World of Finances. Grab your pen and notepad, and join us for some financial inspiration!

Was this info helpful? Please reply….

We're happy to introduce our new app, brimming with tools to revolutionize your financial management.

Dive into budgeting features, stay informed with insightful articles, and utilize our arsenal of calculators tailored to diverse financial scenarios.

Need guidance? Our coaching and support services are at your fingertips. Track and conquer your debts effortlessly with our debt tracker.

Plus, unlock a wealth of knowledge with our comprehensive courses and much more!

Embark on your journey toward financial freedom today by clicking the button below to register for our free 30 day trial period to check it out! No credit card required. :-)

If you’re still working or running a business in 2026, you could be paying more into Social Security than ever before. The Social Security wage base limit is rising again, meaning higher earners will see a larger portion of their income subject to payroll tax. Here’s what’s changing, who’s most affected, and how this could impact your retirement planning strategy.

Seven US Getaways That Feel Like an International Vacation

Dreaming of Paris, Santorini, or Tuscany but not the long flight or jet lag? You don’t have to leave the country to feel like you did. From charming coastal towns to breathtaking mountain retreats, these seven U.S. destinations deliver international vibes with all the comfort of home.

Well thats it for this week, hope you found something valuable in this newsletter. Please share your Good News or anything you’d like me to include in our upcoming newsletter.

Please share with a friend and if you have any questions or comments just reply to this, it comes straight to me:-)

Have a blessed week till next time....

Kind Regards,

Advisory services are offered through Good News Financial & Investment Advisors LLC, an Investment Advisor in the State of MD. Insurance products and services are offered through Affordable Benefits Solutions Inc, an affiliated company. Outgoing and incoming emails are electronically archived and subject to review and/or disclosure to someone other than the recipient. We cannot accept requests for securities transactions or other similar instructions through email. We cannot ensure the security of information e-mailed over the Internet, so you should be careful when transmitting confidential information such as account numbers and security holdings. If the reader of this message is not the intended recipient, or an employee or agent responsible for delivering this message to the intended recipient, you are hereby notified that any dissemination, distribution or copying of this communication is strictly prohibited. If you have received this communication in error, please notify us immediately by replying to this message and deleting it from your computer.